Gen Z's Shifting Substance Use Preferences: Insights and Implications for Emerging Cannabis Markets

Article Written by Adam Isaac Miller

“The next generation has always been and will be better than the previous one. If it is not, then the world would not be moving forward.” Kapil Dev

As the landscape of substance use continues to evolve, I think it is important and exciting to examine the changing preferences among younger generations, particularly Gen Z.

A study by Caulkins (2024) from Carnegie Mellon University observed the increasing popularity of cannabis among Gen Z while also highlighting a decline in their use of alcohol and tobacco. The study further supports these trends, providing valuable insights into the long-term changes in cannabis use in the United States. These findings not only offer a deeper understanding of Gen Z's behavior but also present important lessons for less mature cannabis markets.

Long-Term Trends in Cannabis Use

Caulkins (2024) assessed cannabis use in the United States between 1979 and 2022, using data from the U.S. National Survey on Drug Use and Health and its predecessor. The study examined more than 1.6 million respondents across 27 surveys and concluded that long-term trends in cannabis use parallel corresponding changes in policy over the same period. Notably, the study found that a growing share of cannabis consumers report daily or near-daily use, and their numbers now exceed those of daily and near-daily alcohol drinkers.

Shifting Preferences: Cannabis vs. Alcohol and Tobacco

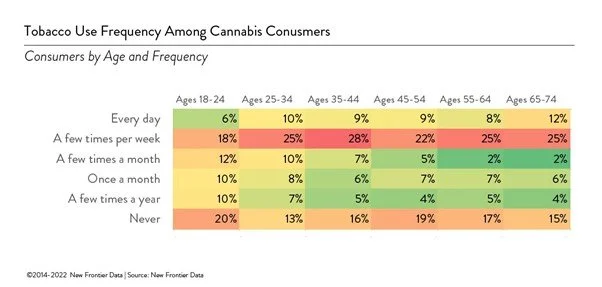

These findings align with a study published in the Journal of Adolescent Health by Dilley et al. (2021), which found that between 2014 and 2019, Gen Zers in Washington state experienced declines in past-month alcohol use, heavy episodic drinking, and cigarette use. The New Frontier Data Consumer Survey (2017-2020) further supports this trend, revealing that cannabis consumers aged 18-24 were the most likely to abstain from alcohol (19.7%) and the least likely to drink daily (5.9%). Similarly, they were the most likely among those under 55 never to use tobacco (39.3%) and the least likely among those under 65 to use it daily (26.3%).

These findings suggest that Gen Z is consciously choosing cannabis over alcohol and tobacco, a preference that extends beyond their age group. According to the New Frontier Data Consumer Survey (2017-2020), more than two-thirds (69%) of people aged 18-24 preferred cannabis to alcohol, with similar preferences observed among those up to age 44. This preference gradually declines with age, reaching 44% for those aged 65-74.

Factors Contributing to the Shift

Several factors may be contributing to Gen Z's preference for cannabis over alcohol and tobacco. As "digital natives" who have grown up in an era of widespread legal marijuana use, they are more comfortable with and accepting of cannabis. Additionally, the COVID-19 pandemic has reset the focus away from bars and clubs and toward home events and gatherings, where cannabis is more easily procured and consumed (Reiman et al., 2017; Lucas et al., 2013).

Moreover, changing risk perceptions among 18-25-year-olds regarding cannabis and alcohol may also play a role. According to data from Cowen Inc., a financial services firm that follows the cannabis sector, this age group's perception of the risks associated with cannabis use has decreased over time, while their perception of the risks associated with alcohol use has increased.

Implications for Less Mature Cannabis Markets

The insights gained from studying Gen Z's substance use preferences and the long-term trends in cannabis use can inform other, less mature cannabis markets. As these markets develop, it is essential to consider the following:

Education and harm reduction: While cannabis may be preferable to alcohol and tobacco in terms of health risks, it is not without its own concerns. Educating younger generations about responsible use and the potential risks associated with cannabis, particularly for developing brains, should be a priority.

Product development and marketing: Companies operating in emerging cannabis markets should consider Gen Z's preferences and values when developing their products. This may include a focus on healthier alternatives, sustainability, and transparency.

Regulatory frameworks: As cannabis markets mature, regulatory frameworks should be designed to prioritise public health and safety, particularly for younger consumers. This may include strict age limits, labeling requirements, and restrictions on advertising and promotion.

Monitoring and research: Continuous monitoring of the impact of cannabis legalisation on youth consumption patterns and public health outcomes is important. Investing in research to better understand the long-term effects of cannabis use and the factors influencing consumption habits among younger generations will help inform policy decisions and industry practices.

Gen Z's shifting substance use preferences, characterised by a growing preference for cannabis over alcohol and tobacco, along with the long-term trends in cannabis use in the United States, provide valuable insights for emerging cannabis markets. By understanding the factors contributing to these shifts and the potential implications for public health and industry practices, these markets can develop responsibly and sustainably. Prioritising education, harm reduction, and research while adapting to the evolving preferences of younger generations will be key to the long-term success of the cannabis industry.

References:

Caulkins, J. P. (2024). Changes in self‐reported cannabis use in the United States from 1979 to 2022. Addiction. https://doi.org/10.1111/add.16519

Dilley, J. A., Richardson, S. M., Kilmer, B., Pacula, R. L., Segawa, M. B., & Cerdá, M. (2021). Prevalence of Cannabis Use in Youths After Legalization in Washington State. JAMA Pediatrics, 175(2), 192-193. https://doi.org/10.1001/jamapediatrics.2020.5258

Lucas, P., Reiman, A., Earleywine, M., McGowan, S. K., Oleson, M., Coward, M. P., & Thomas, B. (2013). Cannabis as a substitute for alcohol and other drugs: A dispensary-based survey of substitution effect in Canadian medical cannabis patients. Addiction Research & Theory, 21(5), 435-442. https://doi.org/10.3109/16066359.2012.733465

New Frontier Data Consumer Survey (2017-2020).

Reiman, A., Welty, M., & Solomon, P. (2017). Cannabis as a Substitute for Opioid-Based Pain Medication: Patient Self-Report. Cannabis and Cannabinoid Research, 2(1), 160-166. https://doi.org/10.1089/can.2017.0012

Adam has spent over eight years working with unregistered medicines. With a specialization in Cannabinoid Therapeutics, Adam has supported the development, implementation, and market entry of multiple cannabinoid product portfolios in markets such as Australia, New Zealand, Germany, and Brazil. Before working in the medical cannabis field, Adam spent almost a decade building various B2B businesses within education, investment, and medicinal cannabis, with progressive roles including business development, strategy, product development, and project management. He has consulted private and listed cannabis producers and ancillary businesses since 2015 as one of the early entrants and experts in the burgeoning Australian cannabis industry. Adam founded and sat on the board of The Medical Cannabis Council, Australia’s first not-for-profit industry body. He is a frequent public speaker and publishes a widely read industry newsletter. Adam earned a Bachelor of Entrepreneurship from the Royal Melbourne Institute of Technology. Adam has appeared in several major news outlets, including the Sydney Morning Herald, The Australian Financial Review, Nine News, Startup Smart, SBS, SkyNews, MJBizDaily, and other major publications.

Disclaimer: This information is shared with a global readership for educational purposes only and does not constitute medical or business advice. All patient-related information has been de-identified OR fictional to protect privacy. Nothing in this article is intended to promote the use or supply of medical cannabis to members of the public.